Executive Summary

This article explores the role of project and program portfolios as the key mechanism for translating strategy into measurable results.

Drawing upon four leading management frameworks—PMI’s Standard for Portfolio Management, Axelos’s Management of Portfolios (MoP), SAFe’s Lean Portfolio Management, and Kaplan & Norton’s Balanced Scorecard (BSC)—the study compares their principles, processes, and governance structures to determine how organizations can achieve strategic alignment and continuous value delivery.

The analysis reveals that all frameworks share five fundamental principles: strategic alignment, portfolio balancing, transparent governance, benefits realization, and feedback-based adaptation.

However, each emphasizes a distinct dimension: PMI stresses structure and control, MoP focuses on benefits and change culture, SAFe introduces agility and lean funding, while BSC integrates quantitative performance measurement through KPIs.

The paper proposes a hybrid portfolio governance model that synthesizes the discipline of PMI, the outcome-orientation of MoP, the adaptability of SAFe, and the measurement rigor of BSC.

This model enables organizations to bridge the persistent strategy-execution gap, ensuring that every investment contributes directly to strategic objectives while fostering continuous learning and organizational resilience.

1. Introduction

In today’s dynamic business environment—defined by rapid technological change, global competition, and constant transformation—the effectiveness of strategic management has become a decisive success factor.

Formulating a strategy is only the beginning; the real challenge lies in executing it.

Research by Kaplan and Norton (2008) indicates that over 60 percent of corporate strategies fail to achieve their intended results due to a persistent execution gap—the disconnect between strategic intent and operational realization.

A key mechanism that bridges this gap is the portfolio of projects and programs.

A portfolio serves as the practical vehicle that translates strategic ambitions into specific, actionable initiatives through which an organization implements its goals.

Portfolios enable organizations to:

- Align resources with priorities.

- Decide where to invest for maximum value.

- Balance short-term and long-term benefits.

- Monitor and control progress toward strategic outcomes.

Without a portfolio-level governance, strategy fragments into disconnected projects competing for the same resources, while failing to deliver consistent value.

Across leading management frameworks, portfolio management is recognized as a central element of strategic control.

The most widely adopted frameworks include:

- PMI – The Standard for Portfolio Management (PMI, 2021);

- PRINCE2 / Axelos – Management of Portfolios (MoP) (Axelos, 2011);

- SAFe – Lean Portfolio Management (Scaled Agile Inc., 2023);

- Balanced Scorecard (BSC) – Kaplan & Norton (1996, 2008).

Despite differences in terminology and methodology, all these approaches view the portfolio as the core mechanism for transforming strategy into measurable results.

Purpose of the paper:

To define the role of the project and program portfolio within the system of strategic management and to compare the methodological approaches of PMI, PRINCE2 (MoP), SAFe, and BSC.

Research objectives:

- Describe the theoretical foundation of portfolio management.

- Analyze how each methodology integrates the portfolio concept into strategy execution.

- Identify similarities and differences among the frameworks.

- Propose an integrated hybrid model suitable for practical application.

Structure:

The paper consists of ten sections—from theoretical context through comparative analysis to conclusions and recommendations—supplemented with tables and diagrams.

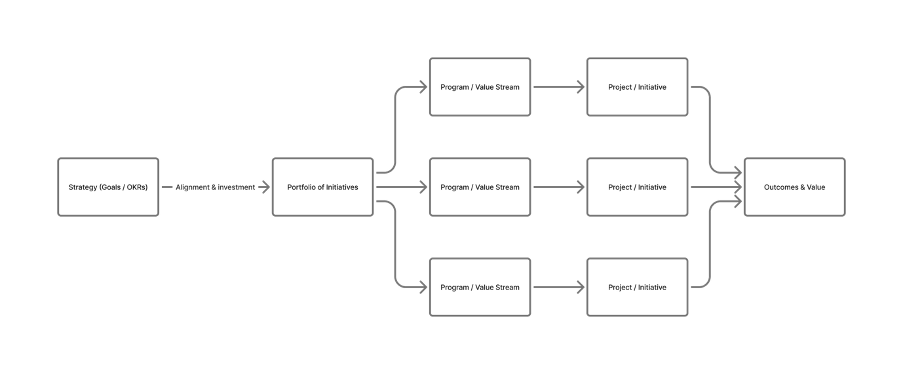

Figure 1. The Place of Portfolio within Strategic Management

2. Theoretical Background of Portfolio Management

2.1 Definition and Essence

A portfolio is a collection of programs, projects, and other work grouped together to achieve strategic objectives (PMI, 2021).

Unlike a program, which aims to deliver specific outputs, a portfolio’s purpose is to select, balance, and oversee initiatives that collectively yield maximum strategic value.

Portfolio management is the process of:

- identifying initiatives;

- evaluating and prioritizing them;

- allocating budgets and resources;

- monitoring progress and benefits;

- reviewing and reprioritizing as conditions evolve.

Its ultimate goal is to optimize the total strategic contribution of all initiatives.

2.2 Evolution of the Portfolio Concept

The idea of portfolio management dates back to the 1950s when organizations began coordinating multiple projects simultaneously.

PMI’s Standard for Portfolio Management (2006) established modern terminology and process logic—categorization, balancing, governance.

In the UK, Axelos introduced Management of Portfolios (MoP), emphasizing benefits realization and change culture.

During the 2010s, the rise of Agile led to Lean Portfolio Management (SAFe), enabling faster reallocation of investments in response to shifting priorities.

Kaplan & Norton’s Balanced Scorecard (1996) added the strategic dimension, linking initiatives to measurable objectives and KPIs across four perspectives.

2.3 Levels of Managing Change: Strategy → Portfolio → Program → Project

| Level | Primary Goal | Key Question | Typical Artifacts |

| Strategic | Define direction | What do we aim to achieve? | Strategic themes, OKRs, BSC map |

| Portfolio | Select & balance initiatives | Where should we invest? | Portfolio Roadmap, Investment Appraisal |

| Program / Project | Execute and deliver results | How do we accomplish it? | Program plan, project charter, benefits register |

Figure 2. Value Hierarchy in Strategic Management

- Output – tangible deliverable (e.g., IT system).

- Outcome – change in behavior or process efficiency.

- Benefit – quantifiable improvement (cost savings, productivity gain).

- Value – sustainable long-term impact for stakeholders or society.

2.4 Core Principles of Portfolio Management

- Strategic Alignment – every initiative must support strategic themes.

- Portfolio Balance – maintain a mix of innovation, operations, and strategic projects.

- Value-based Prioritization – select initiatives with the highest benefit-to-risk ratio.

- Transparent Governance – clear decision criteria and review mechanisms.

- Adaptability – ability to reconfigure the portfolio as context changes.

2.5 The Strategic Significance of the Portfolio Approach

Portfolio management delivers:

- Resource prioritization – directing funds and talent toward highest-value areas.

- Coordinated change – ensuring all initiatives reinforce strategic goals.

- Benefits realization – systematic tracking of achieved outcomes.

- Decision transparency – objective, data-driven investment control.

Thus, the portfolio acts as the bridge between long-term strategy and operational execution, ensuring that every project contributes to measurable strategic value.

3. Portfolio Management According to PMI

3.1 Overview

According to The Standard for Portfolio Management (PMI, 2021), a portfolio is the aggregate of programs, projects, and ongoing operations grouped together to achieve strategic objectives.

PMI’s model does not describe how to deliver a project but what to deliver and why.

Portfolio management focuses on two macro processes:

- Portfolio Definition – creating, evaluating, balancing, and authorizing initiatives.

- Portfolio Performance – monitoring, reporting, and optimizing execution.

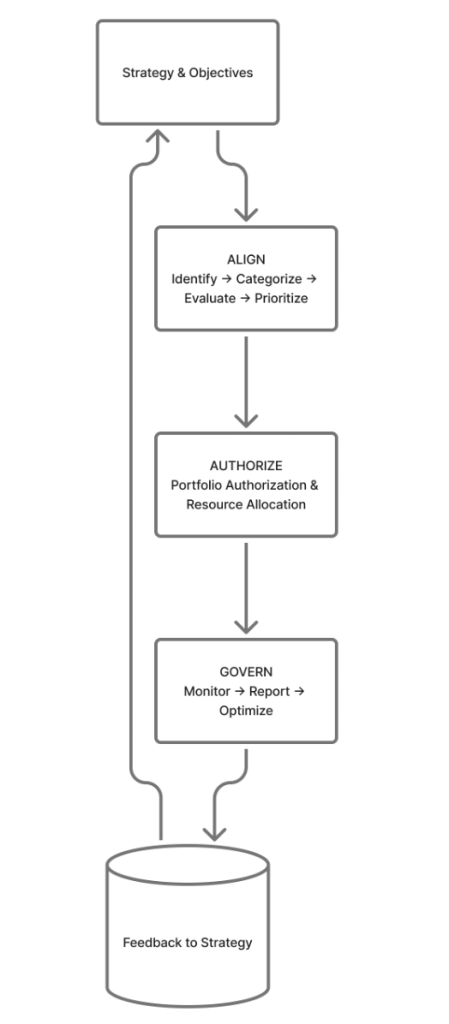

Figure 3 — PMI Portfolio Management Cycle

3.2 Process Domains

| Domain | Purpose | Key Processes |

| Align | Ensure strategic alignment | Identify → Categorize → Evaluate → Prioritize |

| Authorize | Approve and fund initiatives | Portfolio Authorization → Resource Allocation |

| Govern | Control and optimize | Monitoring → Reporting → Optimization |

3.3 Governance and Roles

| Role | Responsibilities |

| Executive Sponsor | Defines strategic priorities, approves portfolio |

| Portfolio Manager | Balances investments, manages portfolio cycle |

| Governance Board | Conducts regular reviews, approves start/stop decisions |

| Portfolio Office | Aggregated analytics and coordination across PMOs |

| Project Management Office (PMO) | Methodological and administrative support for delivery |

3.4 Artifacts and Tools

- Portfolio Charter – purpose, structure, inclusion criteria.

- Portfolio Roadmap – timeline of initiatives.

- Strategic Alignment Matrix – link between initiatives and strategic themes.

- Portfolio Reports – progress, risk, and benefits dashboards.

3.5 Key Metrics

- Strategic Alignment Score

- Portfolio Value Index (PVI)

- Benefits Realization Rate

- Risk Exposure Level

3.6 Portfolio’s Role in the PMI Model

Within the PMI framework, the portfolio is the mechanism that translates strategic goals into approved initiatives while maintaining visibility, balance, and accountability across the enterprise.

4. Portfolio Management in PRINCE2 / Axelos MoP

4.1 Overview

Management of Portfolios (MoP) (Axelos, 2011) complements PRINCE2 and MSP.

Its purpose is to manage organizational change coherently so that every investment produces measurable benefits.

MoP’s principle: “Do the right things, not just do things right.”

Figure 4 — MoP Definition and Delivery Cycle

4.2 MoP Principles

- Alignment with strategy.

- Categorization and prioritization.

- Portfolio balancing.

- Benefits management.

- Embedding portfolio thinking in organizational culture.

4.3 Practices

| Definition Practices | Delivery Practices |

| Portfolio Definition | Benefits Management |

| Categorization | Financial & Risk Management |

| Portfolio Planning | Stakeholder Engagement, Governance |

4.4 Roles and Responsibilities

| Role | Main Function |

| Portfolio Director | Overall leadership and sponsorship |

| Portfolio Office | Coordination and analytics |

| SRO (Senior Responsible Owner) | Achievement of benefits |

| Business Change Managers | Embedding changes into operations |

| Program / Project Managers | Delivering approved initiatives |

4.5 Distinctive Features vs PMI

| Criterion | PMI | MoP |

| Orientation | Process-driven | Culture & benefits-driven |

| Focus | Investment control | Organizational change and learning |

| Governance | Formal | Flexible leadership model |

| Lifecycle | Align – Authorize – Govern | Definition – Delivery |

5. Lean Portfolio Management in SAFe

5.1 Position within SAFe Architecture

The Portfolio level in SAFe connects strategy to execution through a set of Value Streams.

Instead of project-based funding, SAFe applies lean budgeting, financing ongoing value streams.

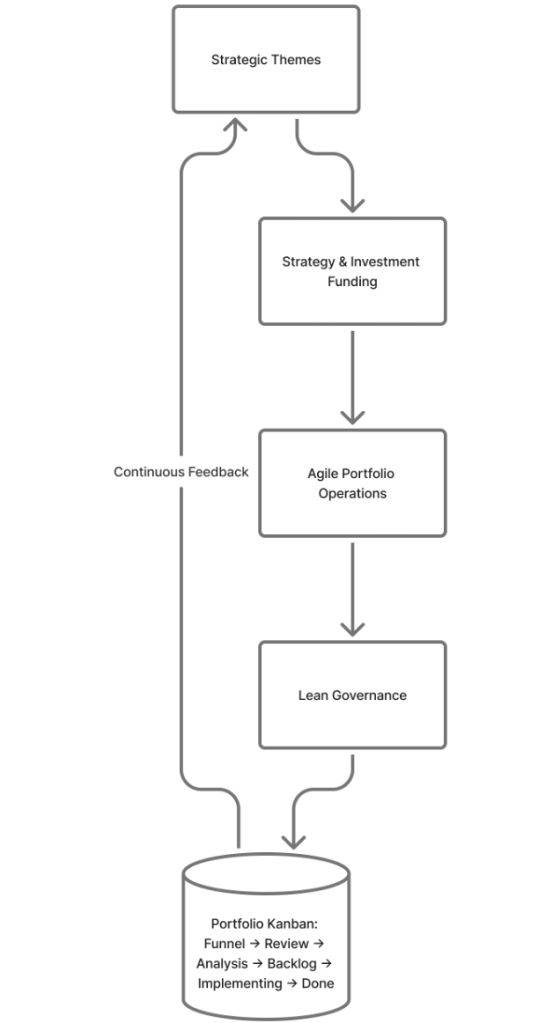

Figure 5 — SAFe Lean Portfolio Management

5.2 Key Components of LPM

| Component | Purpose |

| Strategy & Investment Funding | Allocate investment across strategic themes |

| Agile Portfolio Operations | Coordinate and optimize value streams |

| Lean Governance | Oversee finance, compliance, and metrics |

5.3 Portfolio Kanban and Epic Funding

- Funding is tied to Value Streams, not discrete projects.

- Each Epic includes an Epic Hypothesis Statement (expected benefits, cost, metrics).

- The portfolio Kanban visualizes flow from Funnel → Review → Analysis → Implementation → Done.

5.4 OKR Integration in SAFe 6.0

| Level | Objective | Key Results |

| Portfolio | Improve operational efficiency | Reduce cycle time by 25 % |

| Value Stream | Optimize delivery process | Shorten lead time from 40 to 25 days |

| Team | Increase quality | Reduce defects by 15 % |

5.5 LPM Metrics

- Innovation Investment Ratio (15–20 %)

- Portfolio Flow Efficiency

- Epic Success Rate

- Lean Budget Variance

- Strategic Alignment Score

6. Balanced Scorecard (BSC)

6.1 Conceptual Overview

The Balanced Scorecard (Kaplan & Norton, 1996) provides a system for managing strategy through four perspectives:

Financial – Customer – Internal Processes – Learning & Growth.

The portfolio of initiatives operationalizes these strategic goals.

Figure 6 — Integration of BSC and Portfolio Management

6.2 Link between BSC and Portfolio

- BSC defines objectives and KPIs.

- The portfolio encompasses initiatives that realize those objectives.

- Scorecards provide continuous feedback and visibility.

6.3 BSC-Related Metrics

- Achievement Index – goal attainment.

- Strategy-to-Execution Lag.

- Benefits Realization Rate.

- Learning Cycle Time.

6.4 BSC and SAFe Comparison

| Criterion | BSC | SAFe |

| Purpose | Strategy execution | Adaptive funding of value streams |

| Core Unit | Strategic Initiative | Epic |

| Measurement | KPI / Scorecards | OKR / Flow Metrics |

| Rhythm | Periodic | Continuous |

| Structure | Hierarchical | Networked |

6.5 Portfolio’s Role in BSC Systems

The BSC creates a closed-loop cycle:

Strategy → Objectives → Metrics → Initiatives → Results → Feedback.

The portfolio is the operational engine of this loop, translating strategic intent into measurable outcomes.

7. Comparative Analysis of PMI, MoP, SAFe and BSC

7.1 Shared Logic

Although each framework uses different terminology and processes, they all pursue the same goal — to translate strategy into measurable results through structured governance.

Common principles across frameworks:

- Strategic alignment — initiatives must originate from strategic themes or OKRs.

- Portfolio balancing — optimization of trade-offs between risk, cost, benefit, and time.

- Transparent governance — regular reviews and clear decision rules.

- Benefits realization — success measured by outcomes and benefits, not mere outputs.

- Feedback loops — continuous learning and adaptation of the strategy.

7.2 Comparative Table

| Criterion | PMI (2021) | MoP (Axelos) | SAFe (2023) | BSC (Kaplan & Norton) |

| Purpose | Align investments with strategy | Drive strategic renewal | Lean-fund value streams | Execute strategic initiatives |

| Logic | Align – Authorize – Govern | Definition – Delivery | Strategy & Funding – Operations – Governance | Plan – Execute – Measure – Adjust |

| Focus | Investment control | Benefits & culture | Flow of value, OKRs | KPIs, strategic maps |

| Management Unit | Program / Project | Initiative / Program | Value Stream / Epic | Strategic Initiative |

| Key Metric | Portfolio Value Index | Benefits Realization Rate | Flow Efficiency, Epic Success | KPI Achievement Index |

| Governance | Formal committee | Adaptive leadership | Lean governance board | Strategic office |

| Review Cadence | Quarterly / annual | Continuous | Continuous | Periodic |

| Culture | Process-oriented | Change leadership | Agile / Lean | Analytical / Data-driven |

7.3 Hybrid (Synthesized) Model

| Element | Source Framework | Contribution |

| Strategic Map | BSC | Defines strategic goals in four perspectives |

| OKR Cascade | SAFe | Translates strategy into measurable outcomes |

| Portfolio Balancing | PMI | Optimizes investment mix and resources |

| Benefits Management | MoP | Ensures realization and organizational learning |

| Lean Governance | SAFe | Promotes agility and reduced bureaucracy |

| Feedback Loop | BSC / MoP | Enables strategy refresh and adaptation |

Figure 7 — Synthesized model of strategic management through the portfolio

8. Practical Recommendations for Organizations

8.1 Establishing Portfolio Governance

- Define strategic architecture.

Clarify hierarchy: strategic themes → portfolios → programs → projects. - Set evaluation criteria.

Include strategic relevance, ROI, risk level, and time-to-benefit. - Adopt MoP’s dual cycle (Definition + Delivery).

Ensures continuous renewal of the portfolio. - Use Lean Portfolio Kanban (SAFe).

Visualizes flow and limits work-in-progress. - Hold regular Portfolio Reviews.

Re-assess priorities quarterly or on demand. - Track portfolio KPIs.

Examples: Strategic Alignment Score, Portfolio Balance Index, Benefits Rate, Flow Efficiency.

8.2 Organizational Structure and Roles

| Role | Responsibility |

| Portfolio Sponsor / Board | Approves strategic priorities and investments |

| Portfolio Manager | Coordinates balance, allocations, and reviews |

| Business Owners | Define expected benefits |

| Portfolio Office | Aggregated analytics and cross-PMO coordination |

| Project Management Office (PMO) | Methodological support and delivery oversight |

| Program / Project Managers | Execute initiatives within portfolio boundaries |

8.3 Building the Feedback System

- Conduct quarterly portfolio reviews.

- Apply benefits tracking and lessons-learned workshops.

- Integrate portfolio with financial planning cycles.

- Use digital dashboards (Portfolio Scorecards, Power BI reports, etc.).

8.4 Portfolio Maturity Levels

| Level | Description |

| 1 – Ad hoc | Disconnected initiatives, no central control. |

| 2 – Structured | Basic criteria and reporting established. |

| 3 – Integrated | Strategy linkage and benefits management exist. |

| 4 – Optimized | Lean governance and adaptive funding. |

| 5 – Adaptive | Dynamic re-prioritization based on external change. |

8.5 Typical Pitfalls

- Confusing portfolio, program, and project levels.

- Lack of objective prioritization criteria.

- Measuring success by delivery instead of benefits.

- Poor communication between Portfolio Board and PMO.

- Ignoring organizational learning from results.

9. Conclusions

- The portfolio is the central mechanism of strategy execution.

It translates vision into investments and actionable initiatives. - Each framework offers a unique lens.

PMI focuses on structure and control; MoP on benefits and culture; SAFe on flow and agility; BSC on measurement and alignment. - Integration creates a hybrid approach.

Combining discipline (PMI), benefits focus (MoP), adaptiveness (SAFe), and measurement (BSC) enables a resilient strategy execution system. - Portfolios turn strategy into a learning system.

Through feedback loops and benefits tracking, organizations evolve continuously and close the execution gap. - Cultural transformation is as important as processes.

Portfolio management succeeds only when leadership encourages transparency, accountability, and strategic thinking.

10. References

- Project Management Institute (PMI). The Standard for Portfolio Management, 4th Edition, 2021.

- Axelos Ltd. Management of Portfolios (MoP) Guide, 2nd Edition, 2011.

- Scaled Agile Inc. SAFe 6.0 Framework: Lean Portfolio Management, 2023.

- Kaplan, R.; Norton, D. The Balanced Scorecard: Translating Strategy into Action, Harvard Business Press, 1996.

- Kaplan, R.; Norton, D. Alignment: Using the Balanced Scorecard to Create Corporate Synergies, 2006.

- OECD. Strategy Execution and Value Delivery in the Public Sector, 2019.

- Gartner. Evolving PMOs into Strategy Realization Offices, 2021.

- PwC. Global PMO Survey: Delivering Value through Portfolio Governance, 2020.